To overcome the challenges of climate in today's world, we need to diversify our energy mix. At TotalEnergies, we continue to transform and shift our energy mix to cater to your needs. Our role is to make it easy for you to access new energies so that they become so that they become a part of your everyday life. Today more than ever, our ambition is to be a world-class player in the energy transition. TotalEnergies is moving forward, with you, towards energy that is ever more affordable, cleaner, more reliable and accessible to as many people as possible.

Table of contents:

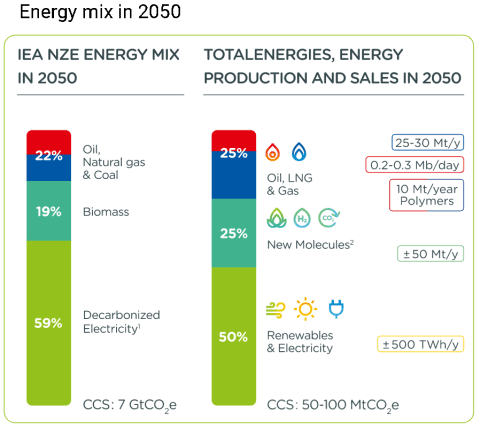

In affirming its ambition to be a major player in the energy transition and to achieve carbon neutrality by 2050, together with society, TotalEnergies has committed to profoundly transforming its production and sales while continuing to meet the energy needs of a growing population.

To do that, we are reinventing and diversifying our energy offering to promote renewable and decarbonized energies, as well as sparing, well-considered use of fossil energies. Since the beginning of the decade, we have moved resolutely to transform our energy model in order to become a multi-energy company and major player in the energy transition.

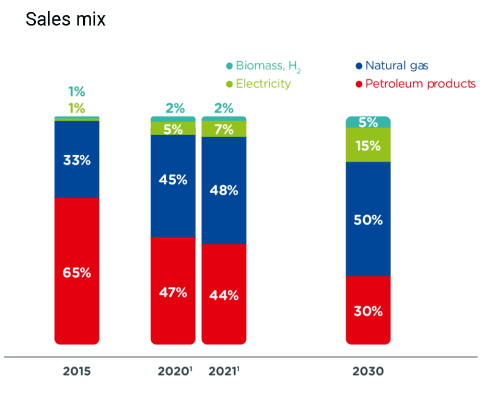

For our Company, this transformation depends on reducing the share of its petroleum products and increasing natural gas, as a transition fuel, and renewable electricity.

Our objectives

To get to net zero together with society, the Company has set short (2025), medium (2030) and long term (2050) emissions reduction objectives.

- In early 2019, TotalEnergies announced its aim to reduce emissions from its operated facilities to less than 40 Mt by 2025 and set itself the target of cutting Scope 1&2 net emissions (including carbon sinks) for its operated activities.

- In order to prepare for the decline in demand for oil by the end of the decade, the Company has embarked on a voluntary strategy of adapting its Downstream activities in the refining and distribution of petroleum products to align them with its oil production, and it has set itself a new target of lowering Scope 3 emissions from petroleum products sold worldwide by over 30% between 2015 and 2030.

Our progress

Emissions from operated facilities have declined by approximately 20% since 2015. This includes 4 Mt of emissions from CCGT power plants following the implementation of the Company’s new strategy in electricity to have flexible generation capacity; the decline for operated oil & gas activities actually came to 30%.

Reducing emissions at the facilities also means developing industrial processes for carbon capture, transport and storage (CCS).

Current CO2 storage projects are mainly located in the North Sea to take advantage of its significant potential, particularly in fields operated by TotalEnergies. Moreover, the regulatory environment within the E.U. is favorable to such projects. Not only will they provide a way to reduce the Company’s own emissions, but thanks to additional capacity, it can also offer CO2emissions storage to its customers to reduce their Scope 1 and our Scope 3 emissions.

We signed in May 2022 an agreement with Sempra Infrastructure, Mitsui & Co., Ltd. and Mitsubishi Corporation for the development of the Hackberry Carbon Sequestration (HCS) project at Cameron LNG, a natural gas liquefaction and export facility located in southwest Louisiana, U.S.

TotalEnergies allocated $100 million to CCS research and projects in 2021, and by 2030 it expects to be expanding storage capacity by around 10 Mt annually.

For indirect emissions associated with customers’ use of its products:

- Scope 3 emissions worldwide have fallen since 2015. In Europe, those emissions fell by 14% (excluding Covid). On oil products alone emissions fell by 19% (excluding Covid).

- The lifecycle carbon intensity indicator for the energy projects it sells has fallen by 10 points since 2015 (excluding Covid).

It makes TotalEnergies the leader among its peers in decarbonizing its energy mix.

Offset residual emissions

In addition to taking action to prevent and reduce GHG emissions, it will be necessary to offset residual carbon emissions for TotalEnergies to achieve net zero emissions together with society.

For that reason, it is investing in natural carbon sinks, such as forests, regenerative agriculture and wetlands.

We invest to preserve and develop ecosystems which sequester carbon naturally*. Our objective : reach an annual sequestration capacity of 5 to 10 million tons of CO2 by 2030.

TotalEnergies and “Forêt Ressources Management” have signed a partnership agreement with the Republic of the Congo to plant a 40,000-hectare forest on the “Batéké Plateaux”. The new forest will create a carbon sink that will sequester more than 10 million tons of CO2 over 20 years, to be certified in accordance with the Verified Carbon Standard (VCS) and Climate, Community & Biodiversity (CCB) standards.

*(For more information about nature-based solutions, read this document)

Gas

For TotalEnergies, natural gas is a key energy for the transition. As the fossil fuel with the lowest carbon emissions, gas is the indispensable ally for helping coal dependent countries reduce their carbon footprint. TotalEnergies is the World’s third-largest LNG Company.

TotalEnergies’ strategy:

- Increase the share of gas to 50% of our sales mix by 2030,

- Consolidate the Company’s position among the top 3 in LNG,

- Integrate the entire gas value chain, from production and trading, including gas-fired power plants and distribution,

- Reduce emissions from this value chain and eliminate methane emissions,

- Work with local partners to promote the transition from coal to natural gas.

Over the last few years, we have acquired combined-cycle gas turbine plants in France, Spain and Belgium to increase our power generation capacity. We now have eight plants in Europe with a capacity of 3.5 GW, and a target of 5 GW by 2025.

This growth requires an exemplary strategy for greenhouse gas emissions. In reducing emissions across the LNG chain, the priority is on methane. The Company is also working on improving liquefaction plant performance, notably in Qatar and the United States, with energy efficiency projects, electrification using renewable solar and wind energy, and native carbon capture and storage. Lastly, TotalEnergies is renewing its fleet of LNG carriers with new vessels that emit on average 40% less CO2 than older ships.

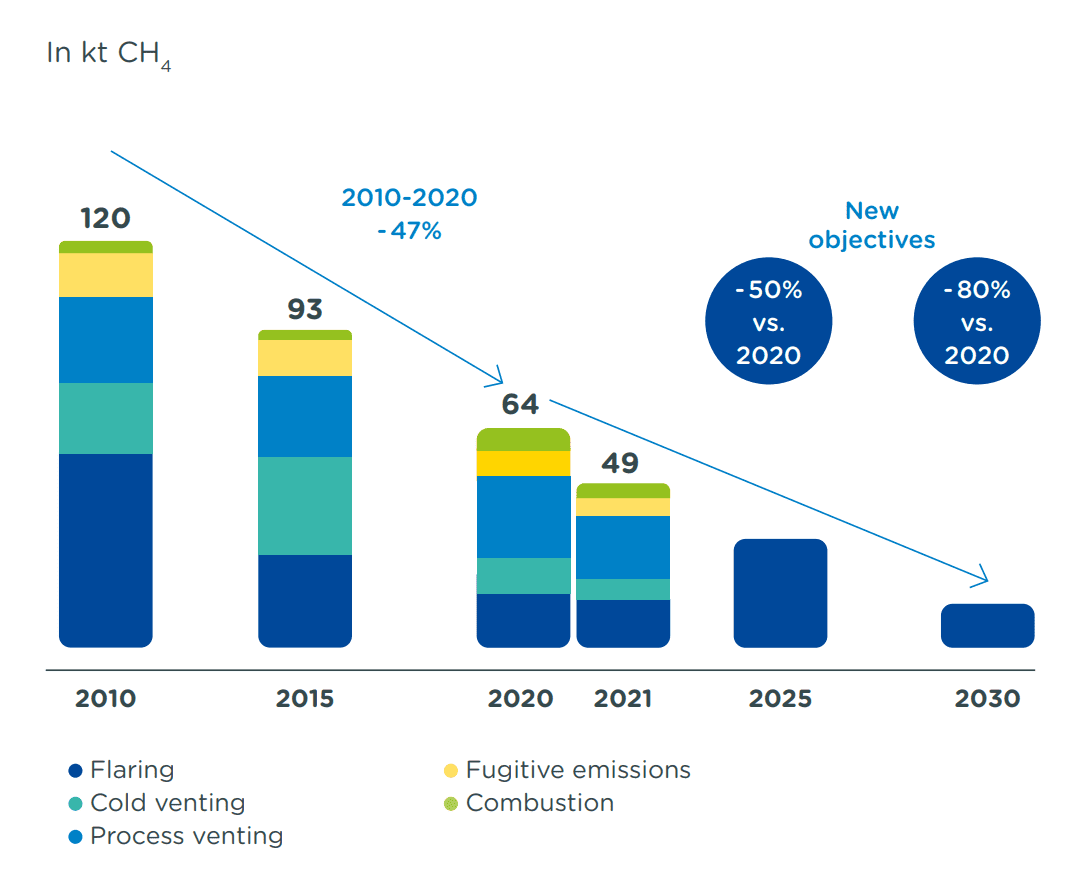

The Company has been working on reducing its methane emissions for several years. It halved its operated methane emissions between 2010 and 2020. In line with the Glasgow agreements, the Company is setting new targets for the current decade:

- Reductions from 2020 levels of 50% by 2025

- and 80% by 2030.

The Company is also maintaining its target of keeping methane intensity below 0.1% across its operated gas facilities.

Methane emissions (operated)

In order to reach zero methane emissions, stronger action will be taken on each of these emission sources:

- Reductions in venting: projects to reroute vents to the gas export system or the flare and to reduce instrument gas on producing assets. In 2021, the decline from the year before linked to reductions in venting came to 6 kt per year (projects in Gabon and the U.K.).

- Reductions in flaring: In 2021, the decrease in flaring from 2020 reduced emissions by 1.8 kt per year.

- Leak reduction: annual campaigns to identify and repair leaks at all operated sites are deployed since 2022. In 2021, emissions declined by 4 kt as a result of leak reduction efforts, including a significant upgrade to the OML58 facility in Nigeria. Moreover, all new projects include strict design criteria for preventing methane emissions: no instrument gas, no continuous cold venting and the systematic use of closed flares. All of these practices have been implemented at the CLOV site in Angola, Moho-Nord in the Republic of the Congo and Egina in Nigeria.

- Methane emissions reduction: TotalEnergies implements a worldwide drone-based detection campaign.

[Special features] LNG : TotalEnergies is investing in an energy of tomorrow

Petroleum

Demand for petroleum products is expected to stagnate and then decline between now and 2030 thanks to technological progress and evolving uses. By 2050, demand will have dropped significantly. These products will face increasingly stringent requirements to limit the emissions related to their extraction and use.

At TotalEnergies, the proportion of oil in our sales mix has declined from 66% in 2015 to 55% in 2019 and should stand at 30% in 2030. By 2050, it could account for between 15% and 20%. However, large investments are still necessary to meet global demand for oil.

The Company focuses on the most resilient oil projects, meaning those with a carbon intensity lower than our existing portfolio average and featuring the lowest breakeven points, below $25 per barrel.

The Tilenga and EACOP projects in Uganda were approved with a low technical cost of $11 per barrel and CO2emissions significantly below those of the current portfolio (13 kg CO2 per barrel vs. 18 kg CO2 per barrel).

In Brazil, the giant Mero project is part of our strategy of producing oil at a competitive cost from worldclass fields.

In 2021, we launched the fourth phase of the project, in the deepwater Santos basin some 180 kilometers off the coast of Rio de Janeiro. This will allow the Company to produce up to 180,000 additional barrels a day as from 2025.

In the same area, we have entered the huge Atapu and Sépia fields, gaining a unique opportunity to access low-cost, low-emission oil resources.

In addition, we respect exclusion zones and good environmental practices. TotalEnergies will not explore for oil in the Arctic Sea ice and will not approve any capacity increases in Canada's oil sands.

Renewable electricity

We are pursuing our expansion in the renewable energies market with the goal of ranking among the top five global players by 2030. We are active across the entire electricity value chain, from production to sales, as well as in strategic storage to support the development of renewable energies, which are intermittent by nature.

Our contribution to the development of renewable energies, as called for in the Net Zero Emissions scenario, accelerated in 2021. Our investments in renewables and electricity accounted for 25% of total investments, which is more than the 20% we forecast in 2020. Combined with our investments in new molecules, this means that soon more than 30% of our investments will be devoted to decarbonized energy.

Between 2017 and 2021, our renewable electricity production capacity rose from 0.8 to 10 gigawatts (GW). This reflects a sharp acceleration in our projects, including large solar projects and wind farms (onshore and offshore) and distributed solar generation for industrial and commercial customers.

In 2021, major partnerships were signed, notably to develop large-scale solar projects in India and the United States.

Our goal is to lift our renewable electricity production capacity to 35 GW by 2025 and 100 GW by 2030. To support renewable power generation capacity, which is intermittent by nature, we develop our electricity storage capacity on a large-scale.

Biomass

From vegetable oils, used cooking oils and animal fat for producing biofuels to organic waste for making biogas, biomass is a promising renewable energy source. It’s an immediately available solution for rapidly reducing mobility’s carbon footprint and replacing natural gas. There’s a challenge to be met here too, because the European Union has set a target of 14% by 2030 for the use of renewables in transportation.

Developing our biofuel lineup

TotalEnergies has been a leader in biofuel research, production and distribution for more than 20 years. With more than 750 service stations offering E85 superethanol, we have France’s largest network* for this bio-based fuel.

In accordance with the European RED II (2018/2021) methodology, biofuels can reduce greenhouse gas emissions by at least 50% compared to their fossil equivalents, making them a tool in the decarbonization of liquid fuels.

Over their lifecycle, biofuels emit over 50% less CO2 than their fossil equivalents (in accordance with European standards), making them a tool in the decarbonization of liquid fuels.

The Company intends to become a major player in the biofuels market and is aiming to increase its sales by more than 10% a year by 2030. To that end, we have converted our La Mède refinery in France into a biorefinery. We launched production of sustainable aviation fuel (SAF) for French airports at La Mède and our Oudalle facility in 2021 and at our Normandy complex in 2022.

Sustainable aviation fuel (SAF) is a blend of conventional aviation fuel (Jet-A1) and biojet fuel made from waste and residue sourced notably from the circular economy (animal fat, used cooking oil, etc.). Biojet fuel has similar properties to Jet-A1 and produces, in accordance with the European methodology Red II, up to 80% fewer CO2emissions over its lifecycle compared with the fossil equivalent.

We will also make SAF at our zero-crude Grandpuits complex as from 2024. At the same time, we are working with Veolia to accelerate the growth of microalgae using CO2to produce new-generation biofuels.

(* source: carburants.gouv.fr)

Accelerating in Biogas

A renewable gas produced from the fermentation of organic matter (manure, farm waste, etc.), biogas is used to make biomethane, which has the same properties as natural gas. Biomethane can be injected into the distribution network or used as alternative fuel for mobility. To help develop this promising value chain, we acquired French market leader Fonroche Biogaz in January 2021, making our Company a major player in renewable gas in Europe.

In the United States, we started construction on our first biomethane production unit in late 2021 in Friona, Texas with renewable gas supplier Clean Energy. This renewable gas will be available in our partner’s North American service stations by 2025.

Towards a circular economy for plastics

As a polymers producer, the Company aims to contribute to the development of a circular economy for plastics and to produce 30% recycled and renewable polymers by 2030. We will get there by pursuing our development in polylactic acid (PLA), a bioplastic made from starch or sugar. This 100% bio-based, recyclable and compostable product is made by our TotalEnergies Corbion PLA joint venture in our plant in Thailand.

Hydrogen

Hydrogen is an energy carrier between primary energy source and final application that does not generate any CO2 during its lifecycle if produced in a decarbonized process.

In addition, the development of carbon storage is paving the way for the development of blue hydrogen using natural gas. This blue hydrogen is produced from natural gas via steam reforming combined with carbon capture and storage.

TotalEnergies is working with its suppliers and partners to decarbonize all the hydrogen used in its European refineries by 2030. This represents a reduction in CO2 emissions of 3 Mt per year. Further out, the Company’s ambition is to pioneer mass production of clean and low carbon hydrogen to serve demand for hydrogen fuel as soon as the market takes off.

In 2020, TotalEnergies and Adani Join Forces to Create a World-Class Green Hydrogen Company

Carbon neutrality: an ambition shared with our customers

TotalEnergies is actively striving to make net zero emissions an ambition it shares with its customers. The primary lever for effectively advancing the energy transition is to gradually change the forms of energy its customers use.

The Company is pursuing a marketing strategy focused on the lowest-carbon products and scaling back its offerings for certain applications where competitive low-carbon alternatives are available. As of 2018, transportation generated approximately 17% of global GHG emissions. The Company’s belief is that the mobility of the future does not call for a single solution, but an array of complementary solutions.

Winning recognition as a major force in electric mobility

As their driving range increases, electric vehicles (EVs) offer a future-oriented solution, accounting for 9% of total vehicle sales in 2021. TotalEnergies is acting on two key links in that value chain to spur adoption of EVs by its customers:

Deployment of charging infrastructure

- 150,000 charge points worldwide by 2025.

- 300 service stations on motorways and major roads and 600 urban service stations with high power chargers (HPC) by 2030 to support e-mobility travel in Europe. This works out to one HPC every 150 km, for optimal coverage on long-distance trips.

- TotalEnergies is transforming and adapting its presence in cities by developing an e-mobility network in Europe and Asia.

Production of affordable, high-performance batteries

- Automotive Cells Company (ACC), a joint venture founded by TotalEnergies and Stellantis in 2020, is set to emerge as a global player in the development and manufacture of automotive batteries beginning in 2023. With Saft, TotalEnergies is giving the new company the benefit of its expertise in R&D. The batteries produced by ACC will power nearly one million EVs a year, or 10% of the European market. Mercedes-Benz joined ACC in September 2021. This is a major investment to contribute to the development of electric vehicles in Europe.

Residential, Commercial and Industrial Uses

By the end of 2021, TotalEnergies sold electricity and natural gas to nine million residential and commercial customers in Europe. TotalEnergies is aiming for nearly 13 million sites (B2B and B2C) across every market segment in 2025. The Company gives preference to power from renewable sources and has developed a range of differentiated offerings for residential and business customers.

For residential customers in Europe, TotalEnergies offers tailored solutions with its Green renewable power service, with rates that are locked in for one year, alongside conventional service offerings. It also helps consumers to save energy.

We are also growing our footprint by staking out a position as a major electricity and gas provider in Europe, with nearly nine million B2B and B2C customers.